Tư vấn bán hàng

The quick ratio is also a more conservative estimate of how liquid a company is and is considered to be a true indicator of short-term cash capabilities. Quick assets are those most liquid current assets that can quickly be converted into cash. These assets include cash and cash equivalents, marketable securities, and net accounts receivable. The principal payment and interest expense are also fixed and known, supposing that the loan is paid back at a consistent rate. It enables accurate forecasting, which allows easier budgeting and financial planning.

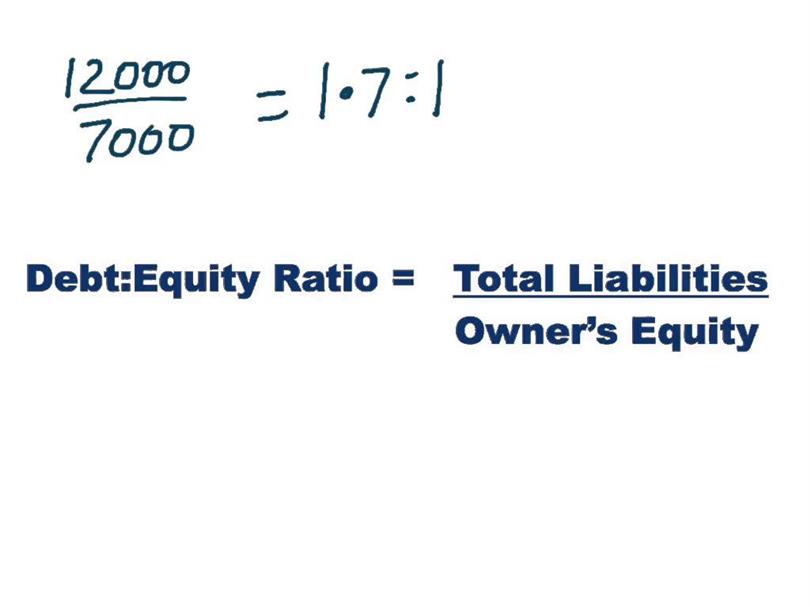

Debt to Equity Calculator (D/E)

In contrast, industries like technology or services, which require less capital, tend to have lower D/E ratios. Generally, a ratio below 1 is considered safer, while a ratio above 2 might indicate higher financial risk. Conversely, a low D/E ratio suggests that a company has ample shareholders’ equity, reducing the need to rely on debt for its operational needs. This indicates that the company xero legal accounting software review is primarily financed through its own resources, reflecting strong financial stability and a lower risk profile. The debt-to-equity ratio is an essential tool for understanding a company’s financial stability and risk profile. By analyzing this ratio, stakeholders can make more informed decisions regarding investments and lending, ultimately contributing to better financial outcomes.

Related Terms

Investors can use the D/E ratio as a risk assessment tool since a higher D/E ratio means a company relies more on debt to keep going. For example, Company A has quick assets of $20,000 and current liabilities of $18,000. Utilities and financial services typically have the highest D/E ratios, while service industries have the lowest. Investors, lenders, stakeholders, and creditors may check the D/E ratio to determine if a company is a high or low risk. Generally, a D/E ratio of more than 1.0 suggests that a company has more debt than assets, while a D/E ratio of less than 1.0 means that a company has more assets than debt.

- The D/E ratio does not account for inflation, or moreover, inflation does not affect this equation.

- The debt-to-equity ratio is calculated by dividing total liabilities by shareholders’ equity or capital.

- If, on the other hand, equity had instead increased by $100,000, then the D/E ratio would fall.

- The D/E ratio of a company can be calculated by dividing its total liabilities by its total shareholder equity.

- It is calculated by dividing the total liabilities by the shareholder equity of the company.

Which of these is most important for your financial advisor to have?

Companies also use debt, also known as leverage, to help them accomplish business goals and finance operating costs. Calculating a company’s debt-to-income ratio requires a relatively simple formula investors can use on their own or with a spreadsheet. In the banking and financial services sector, a relatively high D/E ratio is commonplace. Banks carry higher amounts of debt because they own substantial fixed assets in the form of branch networks. Higher D/E ratios can also tend to predominate in other capital-intensive sectors heavily reliant on debt financing, such as airlines and industrials.

Investors may want to shy away from companies that are overloaded on debt. As a general rule of thumb, a good debt-to-equity ratio will equal about 1.0. However, the acceptable rate can vary by industry, and may depend on the overall economy. A higher debt-to-income ratio could be more risky in an economic downturn, for example, than during a boom. In fact, debt can enable the company to grow and generate additional income. But if a company has grown increasingly reliant on debt or inordinately so for its industry, potential investors will want to investigate further.

Is an increase in the debt-to-equity ratio bad?

✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. Finally, the debt-to-equity ratio does not take into account when a debt is due. A debt due in the near term could have an outsized effect on the debt-to-equity ratio.

In some cases, creditors limit the debt-to-equity ratio a company can have as part of their lending agreement. Such an agreement prevents the borrower from taking on too much new debt, which could limit the original creditor’s ability to collect. In addition, there are many other ways to assess a company’s fundamentals and performance — by using fundamental analysis and technical indicators. In order to calculate the debt-to-equity ratio, you need to understand both components.

Because banks borrow funds to loan money to consumers, financial institutions usually have higher debt-to-equity ratios than other industries. Companies that don’t need a lot of debt to operate may have debt-to-equity ratios below 1.0. The company can use the funds they borrow to buy equipment, inventory, or other assets — or to fund new projects or acquisitions. The money can also serve as working capital in cyclical businesses during the periods when cash flow is low. A D/E ratio of 1.5 would indicate that the company in question has $1.50 of debt for every $1 of equity. To illustrate, suppose the company had assets of $2 million and liabilities of $1.2 million.

Short-term debt also increases a company’s leverage, of course, but because these liabilities must be paid in a year or less, they aren’t as risky. In general, a lower D/E ratio is preferred as it indicates less debt on a company’s balance sheet. However, this will also vary depending on the stage of the company’s growth and its industry sector. D/E ratios should always be considered on a relative basis compared to industry peers or to the same company at different points in time. We know that total liabilities plus shareholder equity equals total assets.

The debt-to-equity ratio (D/E) is a financial leverage ratio that can be helpful when attempting to understand a company’s economic health and if an investment is worthwhile or not. It is considered to be a gearing ratio that compares the owner’s equity or capital to debt, or funds borrowed by the company. If a company takes out a loan for $100,000, then we would expect its D/E ratio to increase.

The results of their IPO will determine their debt-to-equity ratio, as investors put a value on the company’s equity. Having to make high debt payments can leave companies with less cash on hand to pay for growth, which can also hurt the company and shareholders. And a high debt-to-equity ratio can limit a company’s access to borrowing, which could limit its ability to grow. The interest rates on business loans can be relatively low, and are tax deductible. That makes debt an attractive way to fund business, especially compared to the potential returns from the stock market, which can be volatile. The depository industry (banks and lenders) may have high debt-to-equity ratios.