Tư vấn bán hàng

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. From Year 1 to Year 5, the D/E ratio increases each year until reaching 1.0x in the final projection period. Upon plugging those figures into our formula, the implied D/E ratio is 2.0x.

Is a negative debt-to-equity ratio good?

Determining whether a debt-to-equity ratio is high or low can be tricky, as it heavily depends on the industry. In some industries that are capital-intensive, such as oil and gas, a “normal” D/E ratio can be as high as 2.0, whereas other sectors would consider 0.7 as an extremely high leverage ratio. Companies with a high D/E ratio can generate more earnings and grow faster than they would without this additional source of funds. However, if the cost of debt interest on financing turns out to be higher than the returns, the situation can become unstable and lead, in extreme cases, to bankruptcy.

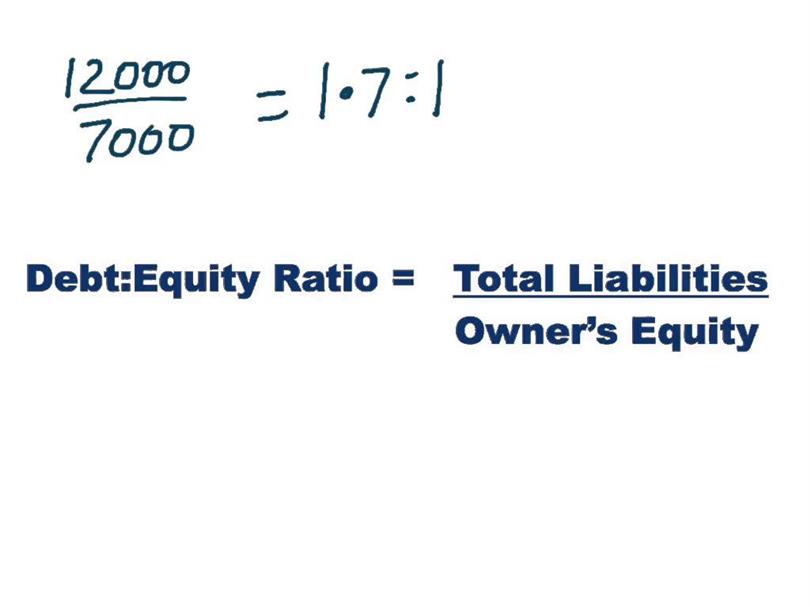

Debt to Equity Ratio (D/E)

Additionally, the growing cash flow indicates that the company will be able to service its debt level. The debt-to-equity ratio is a way to assess risk when evaluating a company. The ratio looks at debt in relation to equity, providing insights into how much debt a company is using to finance its operations. Using the D/E ratio to assess a company’s financial leverage may not be accurate if the company has an aggressive growth strategy. If a company’s D/E ratio is too high, it may be considered a high-risk investment because the company will have to use more of its future earnings to pay off its debts. For example, asset-heavy industries such as utilities and transportation tend to have higher D/E ratios because their business models require more debt to finance their large capital expenditures.

How Can the Debt-to-Equity Ratio Be Used to Measure a Company’s Risk?

Additional factors to take into consideration include a company’s access to capital and why they may want to use debt versus equity for financing, such as for tax incentives. However, if that cash flow were to falter, Restoration Hardware may struggle to pay its debt. For companies that aren’t growing or are in financial distress, the D/E ratio can be written into debt covenants when the company borrows money, limiting the amount of debt issued.

A high ratio may suggest higher financial risk, while a low ratio indicates less risk. Basically, the more business operations rely on borrowed money, the higher the risk of bankruptcy if the company hits hard times. The reason for this is there are still loans that need to be paid while also not having enough to meet its obligations. Suppose a company carries $200 million in total debt and $100 million in shareholders’ equity per its balance sheet.

Does debt to equity include all liabilities?

- For the remainder of the forecast, the short-term debt will grow by $2m each year, while the long-term debt will grow by $5m.

- It’s clear that Restoration Hardware relies on debt to fund its operations to a much greater extent than Ethan Allen, though this is not necessarily a bad thing.

- Very high D/E ratios may eventually result in a loan default or bankruptcy.

- Different sectors have varying norms, and it’s essential to compare against industry averages.

As a result the equity side of the equation looks smaller and the debt side appears bigger. This ratio compares a company’s equity to its assets, showing how much of the company’s assets are funded by equity. keep ghosts off the payroll The debt-to-equity ratio belongs to a family of ratios that investors can use to help them evaluate companies. If earnings don’t outpace the debt’s cost, then shareholders may lose and stock prices may fall.

Conversely, a lower ratio indicates that the company is primarily funded by equity, implying lower financial risk. This ratio also helps in comparing companies within the same industry, offering a benchmark to understand how a company’s leverage stacks up against its peers. The Debt to Equity Ratio (D/E) measures a company’s financial risk by comparing its total outstanding debt obligations to the value of its shareholders’ equity account. Therefore, even if such companies have high debt-to-equity ratios, it doesn’t necessarily mean they are risky. For example, companies in the utility industry must borrow large sums of cash to purchase costly assets to maintain business operations.

These balance sheet categories may include items that would not normally be considered debt or equity in the traditional sense of a loan or an asset. High debt to asset ratio may indicate that the company has high leverage, meaning the assets of the company are funded with more debt. When revenues are high, the company can easily amplify its profits, but when the revenue is low, this high leverage may lead to a strain on the company’s financials. On the other hand, a low debt to asset ratio might imply that the company relies less on debt and would have more flexibility to absorb any financial shocks.

Publicly traded companies will usually share their balance sheet along with their regular filings with the Securities and Exchange Commission (SEC). Making smart financial decisions requires understanding a few key numbers. This number can tell you a lot about a company’s financial health and how it’s managing its money.